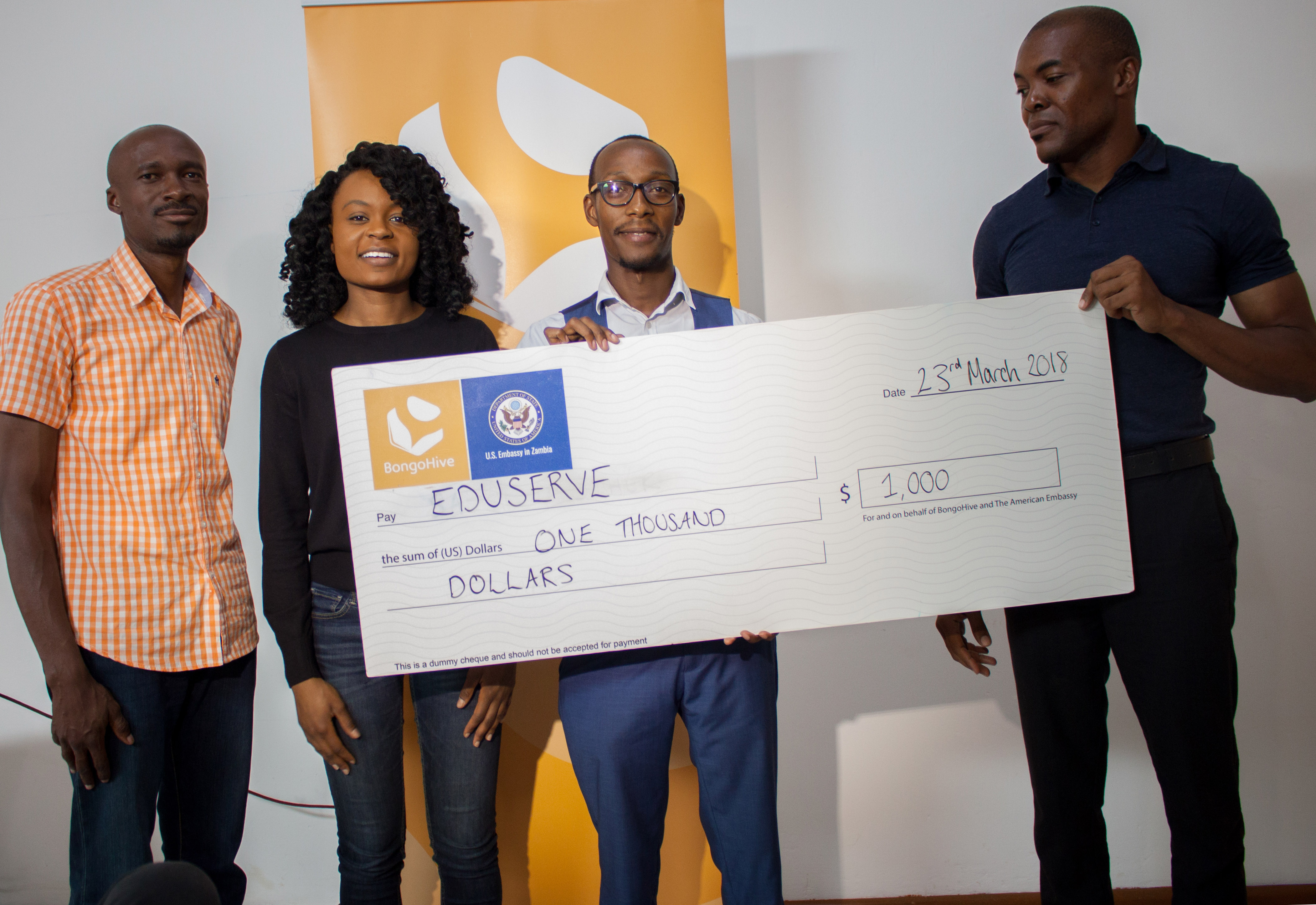

Eduserve, a microfinance startup company designed to specifically facilitate loans for school fees won the Entrepreneurship Bootcamp: FinTech. The startup won $1000 worth of seed investment for the advancement of their project after completing the bootcamp at the Pitch event which was held on Friday 23rd March 2018.

Eduserve, with founder, Dominic Kapalu was in the programme with two other FinTech startups, Sungapo: A USSD application converting talktime into money to facilitate more convenient bill paying & sending money by Montell Chinengu, James Selwa & Kahinga Selwa. And Lance Finance: a microfinance & Investing firm by Chitehwe Lancelot Mutale & Mukubesa Kamutumwa.

The entrepreneurship bootcamp: FinTech theme opened for applications to those with ideas or skills for building businesses around finance and technology. Selected participants went through a 2-day ideation session to brainstorm, test and scrutinize business ideas. From there, they entered a 3-week Discover Pre-accelerator stage to refine & validate their business ideas, helping them get ready to launch their businesses. They received daily training sessions at BongoHive help them build a business model, prove their market, create sound financial projections and learn how to pitch.

For each theme, the entrepreneurship bootcamp culminates with a pitch event where all teams pitch to business leaders. The FinTech theme pitch event had Chinedu Koggu, CTO at Probase, Ruth Lawanson, an American business strategist & Zerubabel Kwebiiha Jnr, a digital finance expert from UNCDF.

“Financial Technology, nowadays better known under the term ‘fintech’, describes a business that aims at providing financial services by making use of software and modern technology. Today, fintech companies directly compete with banks in most areas of the financial sector to sell financial services and solutions to customers. Mostly due to regulatory reasons and their internal strucutres, banks still struggle to keep up with fintech startups in terms of innovation speed. Fintechs have realized early that financial services of all kinds – including money transfer, lending, investing, payments, … – need to seamlessly integrate in the lives of the tech-savvy and sophisitcated customers of today to stay relevant in a world where business and private life become increasingly digitalized.” – FinTech Weekly

Applications are now OPEN for the Retail & eCommerce theme of the Entrepreneurship Bootcamp.

BongoHive

BongoHive