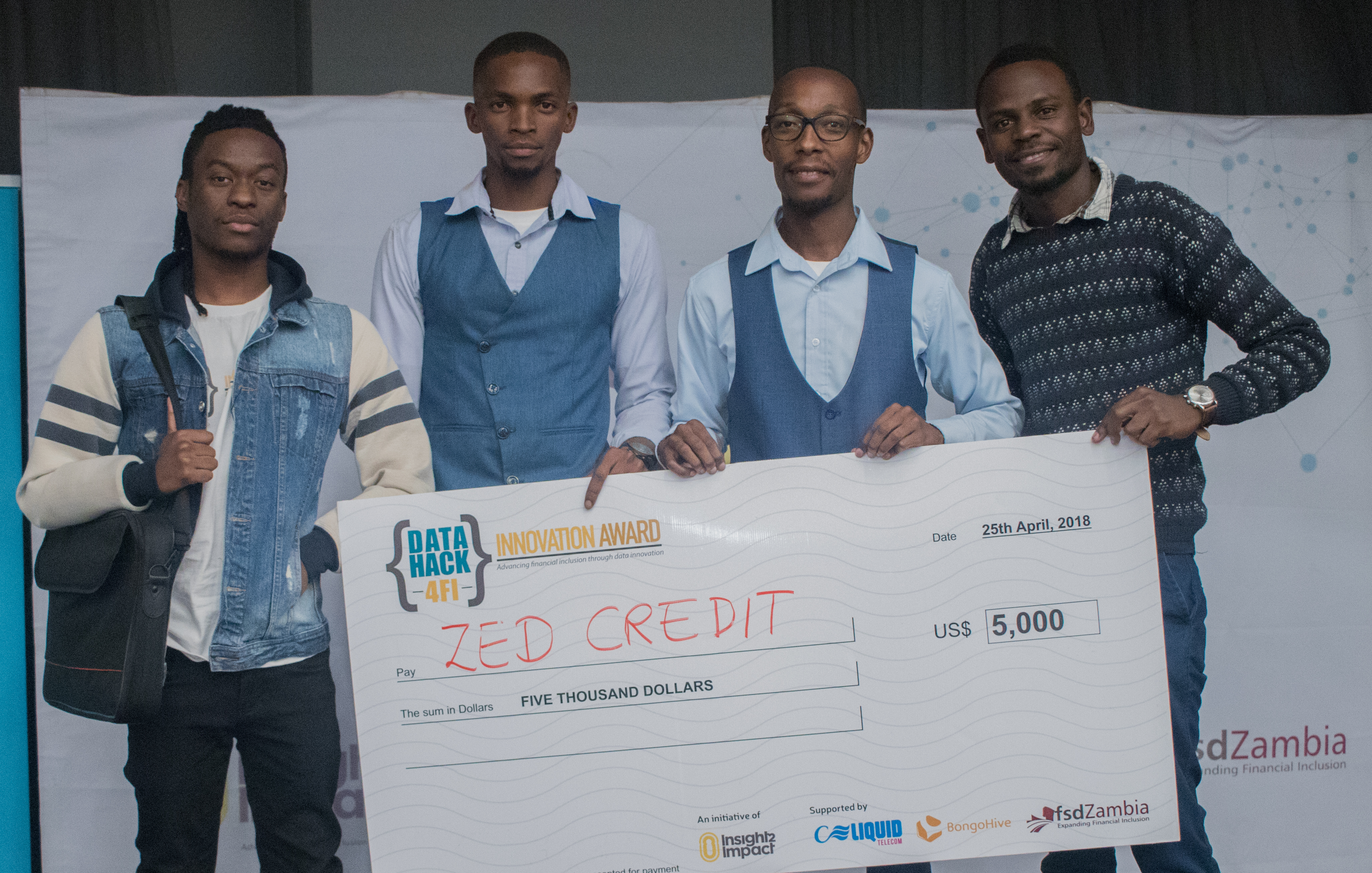

ZedCredit, a local startup that digitizes savings groups records and automates their manual processes has won the DataHack for Financial Inclusion (DataHack4FI) Zambia competition. The DataHack for Financial Inclusion (DataHack4FI) an African innovation competition that encourages finance, tech and data enthusiasts to collaborate in using data and analytics to solve business challenges and extend financial services to underserved communities. The competition this year took place for the second time in Zambia and is also held in Uganda, Kenya, Rwanda, Tanzania, Ghana and Zambia.

OutSource Now, another local startup which helps micro merchants keep track of their business records using a mobile app called Z’POS. The app also helps improve the merchant’s credit score and makes it easy for FSPs to gauge the creditworthiness of a merchant won the USD$2500 prize for a product that targets women and the youth. The two winning startups will now proceed to the Africa competition, due to be held in Rwanda on 9-10 May 2018 during Transform Africa Summit, where they will compete for $25,000 and seed funding from global investors.

The DataHack for Financial Inclusion Zambia final which took place last evening, Wednesday 25th April 2018 at Lusaka’s Radisson Blu hotel was officiated by Patrick Mutimushi, Director General Zambia Information and Communications Technology Authority (ZICTA). “We recognize the need to support financial inclusion and digital financial services. ICT development has evolved in our country to such an extent that data can be harnessed for purposes of financial inclusion. The authority practices a light form of regulation which allows for experimentation for various innovations in the sector,” said Patrick Mutimushi.

Mr Mutimushi also spoke about how ZICTA in the recent past has taken an interest in the issues of financial inclusion as the popularity of digital financial services continues to increase. “As an authority, we are an active participant in local fora by the likes of Financial Sector Deepening Zambia (FSDZ) and The United Nations Capital Development Fund (UNCDF). We have also been given a place on the nation financial inclusion strategy implementation committee,” said Mr. Mutimushi.

Financial Sector Deepening Zambia (FSDZ) CEO, Betty Wilkinson said “financial services are the lifeblood of an economy. They can be a valuable tool for addressing inequality and poverty and building opportunity for all. Fsd zambia believes in financial inclusion and in expanding it to create jobs, to improve livelihoods, to grow, and to reduce risk and vulnerability for families in our country. We at fsdz believe that interventions such as the data hack for financial inclusion are the beginning of Zambia demonstrating that it has the capacity and capability to build zambia’s economy without leaving the disadvantaged and unserved behind. Our young population can use technology as an essential tool to grow and innovate, and to become the next wakanda. The fintechs and data science fellows here today are showing us that they hold amazing potential for realizing financial inclusion, not only in Zambia, but globally,” said Ms Wilkinson.

Other participants of the DataHack4Fi Zambia 2018 Competition were Affordit, Broadpay, Probase and Zambian Pawn. The judges included Clotilda Mulenga, Head Strategic Marketing & Communications at FNB Zambia, Nkaka Mwashika, Executive Director at Insurers Association of Zambia, Francis Mumbi, Product Innovation and Digitization Lead at Stanbic Bank Zambia and Nicola Schoeman, Data Science Project Manager at Impact2Insight (i2i). The participants of the competition were judged on their proven ability to impact more people, level of capacity building demonstrated, use of data and analytics, and the extent to which they were addressing financial inclusion.

In Africa, in the last year alone, 75 million internet uses and 45 million mobile connects were added. Informal economic activity, where 80% of adults in Africa work, is being digitized through innovative data capturing methods. Data is now being used by consumers and businesses to prove their identity, demonstrate their creditworthiness and reveal their needs for payments, savings and insurance products.

The DataHack for Financial Inclusion (DataHack4FI) competition is an initiative of Impact2Insight (i2i), in partnership with BongoHive, CEC Liquid Zambia and Financial Sector Deepening Zambia.

BongoHive

BongoHive