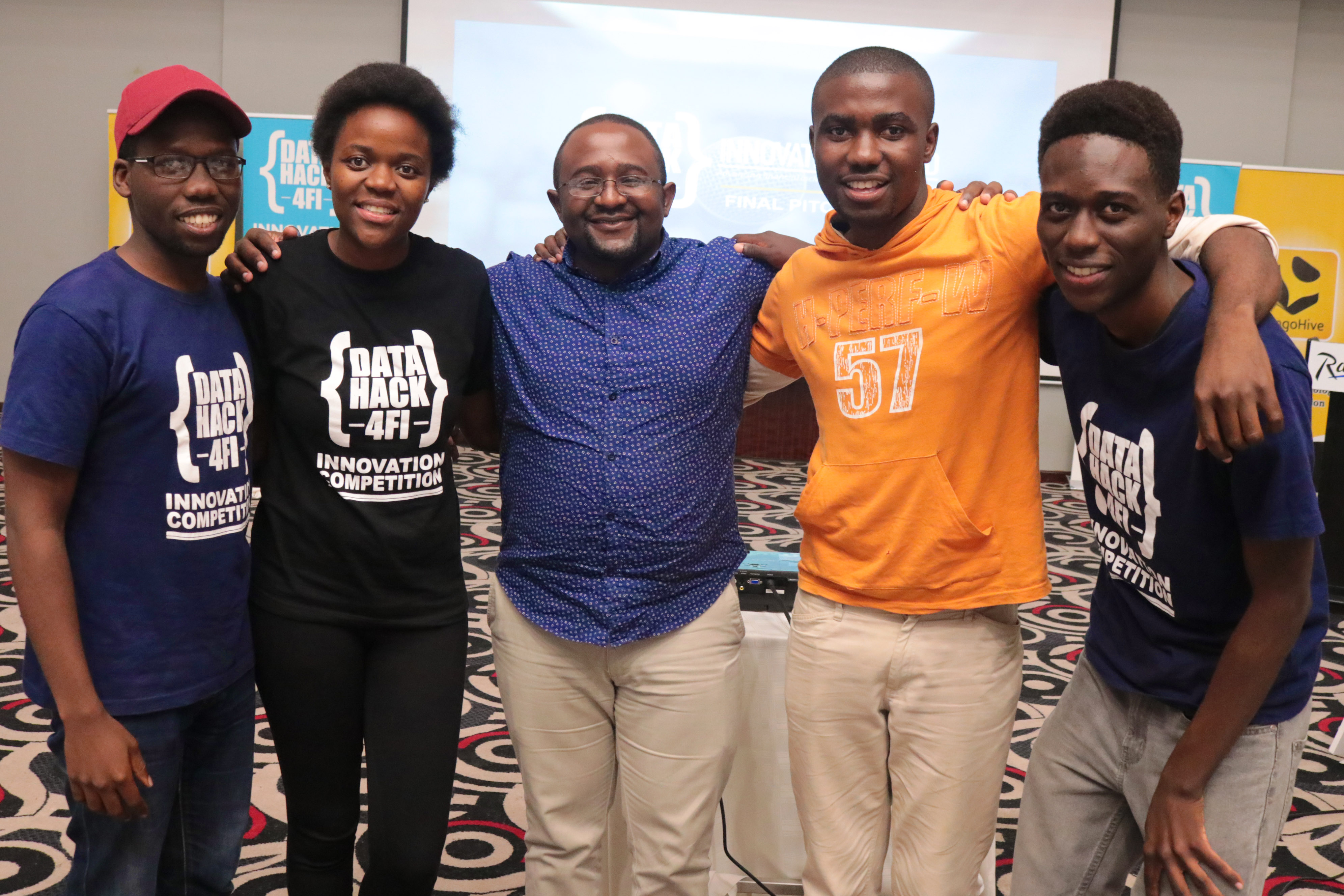

Last night, we hosted the Data Innovation competition final where Team Binary won the competition with a product on financial inclusion for insurance through education with their target market size being the over 7000+ students at the University of Lusaka. Students can have the option of paying insurance premiums using mobile money. Insurance companies are the customer, students are the users. The team won an all expenses paid trip to Transform Africa Summit in Kigali, Rwanda where they will represent Zambia and compete in the Data Innovation competition Africa finals with finalists from 7 other African countries.

In 2nd place was Team BlockHeads with Agripredict using agricutlural tech to reduce misfortune for farmers by using local weather data to and localizing that data to give farmers more information about weather, enabling them to make decision about how to manage their crop/livestock and avoid misfortune to their stock. The product is an AI platform that collects weather data from met stations, pass it through their prediction system. BlockHeads gives to the solution of the problem that current insurance schemes for agriculture are costly for most farmers. Agripredict comes in SMS, USSD, and will soon have voice and local languages in the package. Agripredict will make money through software as a service, hardware (IoT and sensor technology) and insurance brokerage.

And Team Nemo in 3rd place with N2F (Need to fund) a system trying to solve problem of lack of financial services like loans or grants for SMEs. They have built a product called N2F that is a network of lenders/investors and startups. N2F aims to have collective number of people sharing financial risk at minimal cost. An account will have to be created at an N2F agent’S location, then registration is done through app, allowing the startup to then pitch to impress potential investors. N2F is available on Android. Interest rates are low at 10% compared to 42% by others, and no collateral is needed for business loans.

The Data Innovation Competition (Zambia) was launched in March 2017 by Insight2impact (i2i) in partnership with BongoHive Lusaka’s technology and innovation hub, Financial Sector Deepening Zambia and Insurers Association of Zambia to create solutions that advance financial inclusion in Zambia with the use of data. Applicants of the competition where invited to take part in a 2.5 day hackathon called the DataHack4Fi at BongoHive. The hackathon attracted about 25 participants, awesome and eager to create solutions to solve problems in financial inclusion and insurance in Zambia. The competition brought together data specialists (analysts and software developers) and Financial Service Providers (FSPs) to use data to create innovations that address low financial inclusion in Zambia. Seven (7) teams emerged during the hackathon and made it to the semi’s of the competition where they underwent a 4-week mentorship programme.

During the pitch event, six (6) teams pitched to impress a panel of judges and be proclaimed the best solution of the challenge. The judges were Collins Musamba of Zoona, Elias Chipimo of the FSDZ board, Austin Chijikwa of ZANACO and Kambole Chituwo of IAZ.

The competition is the first of its kind in Zambia but is running in seven other countries across Africa, including: Rwanda, Kenya, Tanzania, Uganda, Ghana, Senegal and Mozambique.

BongoHive

BongoHive